Are you also getting charges from Gobrands inc charge on credit card then no need to panic in this article we are going to explain everything in detail about why these charges on your credit card and how you can remove them are all legit or fraudulent.

Gobrands inc charge on credit card mostly related to your food delivery app, which is called GoPuff. This app allows users to buy food and snacks.

What is Evolution Technology Charge on Credit Card?

What is the 1600 Amphitheatre Charge on a Credit Card? Is Legit?

What Gobrands inc charge on credit card?

The charges may occur. The brand is a parent company of a group of which is a food delivery app operated in the United States.

Some reason for Gobarand charge credit

- Recent Gopal order

- Free trial conversion

- Subscription annual

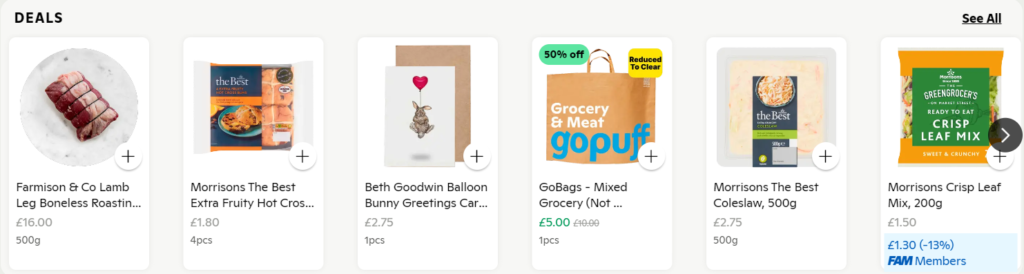

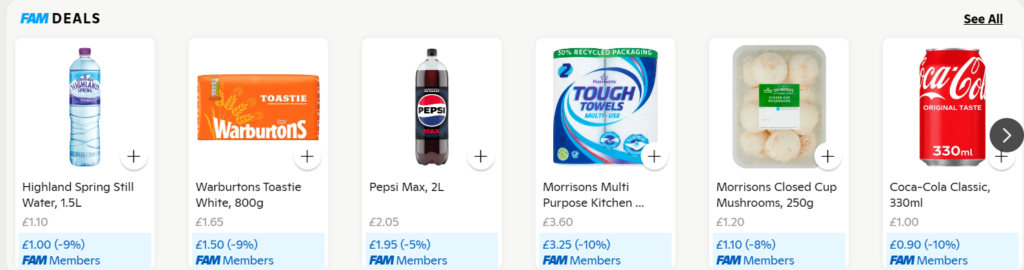

Gobrand is a convenient delivery service offering a wide range of products including a grocery snack for household essentials and some over-the-counter medication Users can go to their app or website and order snacks groceries groceries whatever they want.

These are all items delivered just in 30 minutes.

What is Gobrands inc charge on credit card?

Most people nowadays are very lazy so they always like to order from an app that delivers instantly to their houses there are chances that you have ordered some groceries snacks drinks. You order something through the GoPuff app and you use your credit card on the app or a website so that these charges are reflected in your credit card Statement.

So if you thought these are, these charges are unrecognized or unorganized. Transactions not done by you then you can directly contact your bank provider or credit card or you can also contact the puff app.

Is Gobrands inc charge on credit card Legit?

This depends on the user it’s if you purchase something from their website or you are using their item then it is a legit transaction or credit card done by you or your family member that is using our credit card.

Are you saying that the charges are unauthorized then immediately contact your bank and credit card provider and just block our credit card?

How to remove Gobrands inc charge on credit card?

To remove these types of charges from your credit card better to contact your bank or credit card provider.

Because they have all the information regarding your transaction they will tell you the exact date time and the business name where you spend your money and you can also contact the group for This type of transaction. Your bank credit card provider will help dispute your charges.

How Can I remove Charges from My credit card?

Removing charges from your credit card involves a few steps, depending on the nature of the charges. Here’s a general guide:

1. Review the Charges

- Check your statement: Identify the specific charges you want to dispute. Note the date, amount, and merchant.

- Ensure they’re unauthorized: Confirm that the charges are not from a subscription or purchase you forgot about.

2. Contact the Merchant

- Call or email the merchant: If the charge is from a known merchant, contact them first to resolve the issue directly.

- Provide details: Give the merchant all relevant information (date, amount, and any transaction IDs) to facilitate the resolution.

- Request a refund: Politely ask for a refund if the charge is incorrect or unauthorized.

3. Contact Your Credit Card Issuer

- Call customer service: Use the phone number on the back of your credit card.

- Use the issuer’s website or app: Many issuers have online dispute forms.

- Provide necessary information: Be ready with details about the charge (date, amount, and merchant) and why you believe it’s incorrect or unauthorized.

- Follow up in writing: Send a written dispute letter to the address provided by your issuer, detailing the disputed charge and your contact information.

4. Document Everything

- Keep records: Save copies of all communication with the merchant and your credit card issuer.

- Monitor your account: Regularly check your statements to ensure the charge is removed and no new unauthorized charges appear.

5. Legal Rights and Protections

- Know your rights: Under the Fair Credit Billing Act (FCBA) in the U.S., you have 60 days from the date of the statement to dispute a billing error.

- Understand protection: Many credit card issuers offer zero liability protection for fraudulent charges.

Example of a Dispute Letter:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Credit Card Issuer’s Name]

[Dispute Department]

[Issuer’s Address]

[City, State, ZIP Code]

Re: Dispute of Unauthorized Charge

Dear Sir/Madam,

I am writing to dispute a charge on my credit card statement dated [Date of Statement]. The charge in question is for [Amount] from [Merchant Name] on [Transaction Date].

This charge is unauthorized because [Reason for Dispute]. I have already contacted the merchant to resolve this issue, but have not received a satisfactory response.

Please investigate this charge and remove it from my account. Enclosed are copies of my credit card statement highlighting the disputed charge and any relevant correspondence with the merchant.

Thank you for your assistance.

Sincerely,

[Your Name]Follow Up

- Check response time: Your credit card issuer should respond to your dispute within 30 days.

- Temporary credit: Some issuers may issue a temporary credit while they investigate your claim.

By following these steps, you should be able to effectively dispute and potentially remove unauthorized or incorrect charges from your credit card.

Final Words

Charges are most likely related to your recent purchase on the group of all you have you have taken a trial on their website of the group of or any subscription-related charges. charges, identify legit or fraud.