The complex world of personal finance credit card charges can be sometimes buzzing and concerning. One that often raises your eyebrows is the SQ Credit Card Charge. Not an SQ Credit Card Charge exceeded $1000 orange insurance was originally implicit so you are not alone.

This article aims to explain the What is SQ Credit Card Charge. Explain why they might be paid on the step to encounter the unexpected and suspicious transaction.

What is Luxtonicware Charge on Credit Card?

What is the SQ credit card charge?

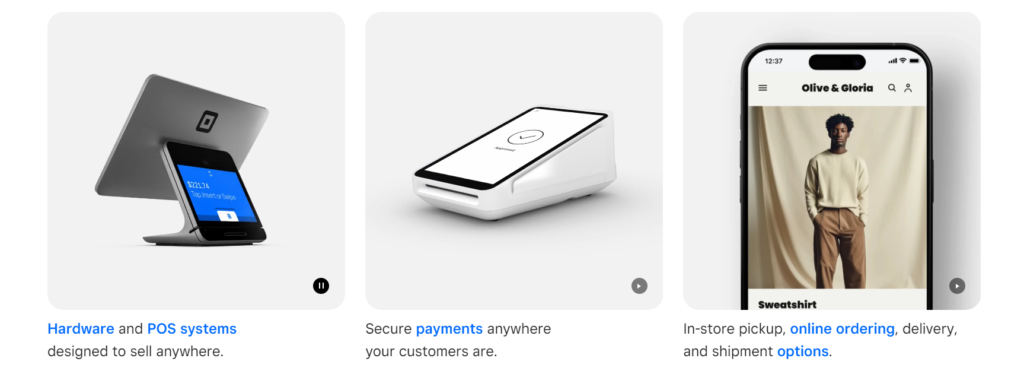

SQ stands for Square Avoid used payment processing services that provide a point of sale(POS) system and payment processing solution for a variety of businesses ranging from all small local shops to large enterprises when you see SQ charge on a credit card statement that your transaction service was processed through the system.

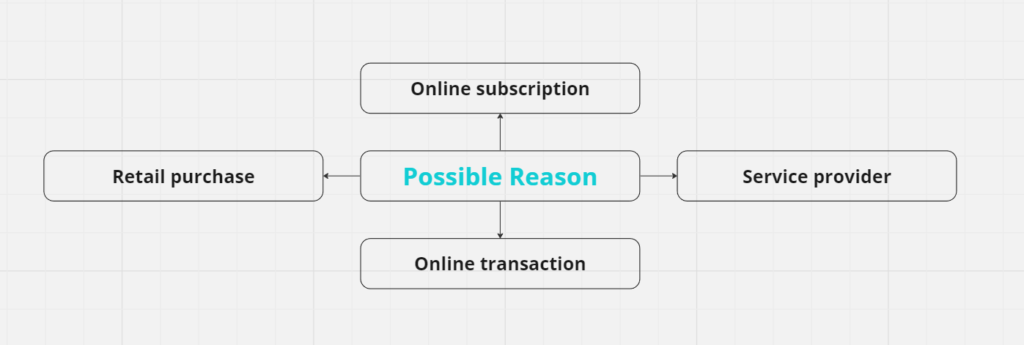

Some common reasons for SQ Credit Card Charge

These are some common reasons for SQ Credit card charges.

Retail purchase:- where are the chances that you have used your credit card in a retail shop that is using a square payment processing? It can be a boutique and purchase and services from farmers market a charge may be an SQ transaction.

Online transaction:- also have a facility for online payment. Purchasing an online store that uses it could explain the square charges.

Service provider:- being a freelance consultant and the service provider is often Square to build their clients. And recent appointments with your personal trainer and hairdresser or therapist.

Online subscription:- the chances are very rare but card charges might be recurring payment subscription services that use payment processing.

How to identify the source of SQ charges on credit card

Encountering an SQ charge on the credit card statement that you won’t recognize. It is essentially to investigate. Here are some steps that you can identify your resources.

- Check the recent transaction:- By checking your recent transaction and date and time from there, you can match or recall where you use your card.

- Contact the merchant:- If you suspect the charges are from the particular business but are not certain contact them direct directly. A merchant using a square wheel has recorded the transition and can confirm the charges from them.

- Unauthorized charges from Sc Square credit card:-Analysing credit card details the new final finds that the charges are authorized and incorrect. It is crucial to act promptly. Here are the steps that you can take to dispute the charges.

- Contact credit card:- The best way to contact your bank and CC card provider about the unsigned transaction. Temporarily they will freeze your charges and begin to investigate credit card companies offering liability of the front transitional protection protecting you from paying for charges.

- Documentation:- Comply with any documentation such as a received email in the correspondence with the merchant that evidence will support you during the process.

- Follow up:- Stay in touch with the credit card issue throughout the investigation and be prepared to provide additional information to clarify as needed.

- Monitor your statement:- Always keep an eye on your credit card statement for any further unauthorized activities. It’s suspicious.

Final word

SQ credit card charges are generally associated with the transaction process through the square payment process that is used by many businesses. Charges are common transactions that can cause concern if encounter SQ charges exceeding $1000 that you don’t recognize.

It is essentially an investigation promptly by checking recent transactions and contacting both the merchant and utilizing the support you can identify the source of the charges.

FAQ

What are SQ payments?

The Square is one of the largest and most notable names in the world of mobile payment

What is a square 2.6 fee?

The in-person tab dip swipe is a 2.6% fee.