Jyoti Structures Share Price Target for 2025 minimum price ₹25 in the maximum is ₹35.

Get ready to envision the future! Jyoti Structures, the talk of the market, is painting a roadmap ahead. The crystal ball is out, predicting where their share prices might soar—2025, 2030, 2040, even 2050! Let’s take a peek into the potential heights their stock might reach and what could steer this financial journey

Nowadays, the Nifty bank nifty, and the Indian stock market are bullish in that most of the stock is having good moves, and most of the treated make good money today we will discuss the Jyoti structures.

Madhav Infra Share Price Target 2025

we will understand the structure of the company and we will understand the balance sheet of a company. What are the sales of a company, how the company is making a profit and what is the return on the stock?

Currently, the stock is in bullish trading at Rs 20.10.

The Jyothi Structure Company is engaged in manufacturing transmission, line tower substations, structures, tall towers, and the master railway electrification structure. The company also offers to design, testing, manufacturing, sourcing, supplying, and construction services.

Jyoti Structures Share Price Target 2025

The sales of the Company quarter on quarter are increased from March 2022. The company has a sales of two crore now in March 2023. The company has sales of 156 crore. The compounded sales growth of Jyoti structure in the past three years is 141% percent and in the past five years is -7%.

In the past five years from March 2018, the sales were Rs 324 crore. After that, the sales will decrease continuously in March 2021. The sales were zero but now the sales are increasing so this could be considered a good sign for a company to recover back. Jyoti Structures Share Price Target for 2025 minimum price ₹25 in the maximum is ₹35.

Jyoti Structures Share Price Target 2030

In September 2023 the company declared 11 crore profit which was good from the past three quarters in September 2022. The company has a loss of four rupees now after one near the company in profit of Rs 11 Crores.

The company has had good profit growth in the past three years compounded profit growth of a company 26% in the past five years of the complete growth is 15%. Jyoti structure share price target for 2030 the minimum is ₹45 in the max is ₹62.

Jyoti Structures Share Price Target 2040

financially, in 2023 the total revenue of the company is 231.07 crore, which is a 4000 times increase from the previous year. vani Degli, the net income grew financially from 2021 to 2022 was 97.5% in 2023 that is grown by 90.43% so in the past two years, the company did a really good growth, the income of the sales total revenue net profit now the stock is also moving according to the balance sheet. Jyoti Structure share price target for 2030 is a minimum is ₹70 in a maximum is ₹90.

Jyoti Structures Share Price Target 2050

In the last five years, the revenue growth averaged 1488.32% versus industry growth of only 12.78%. and then netting came in the past five years. The average growth is 47.9% versus the interest average is 24.63%.

The promoter has a zero shareholding in the company and the public has 92.81% of the total she is rolling in the DII. It has 71.5% of gold so that is not good. Jyoti Structure share price target for 2030 is a minimum is ₹90 in a maximum is ₹120.

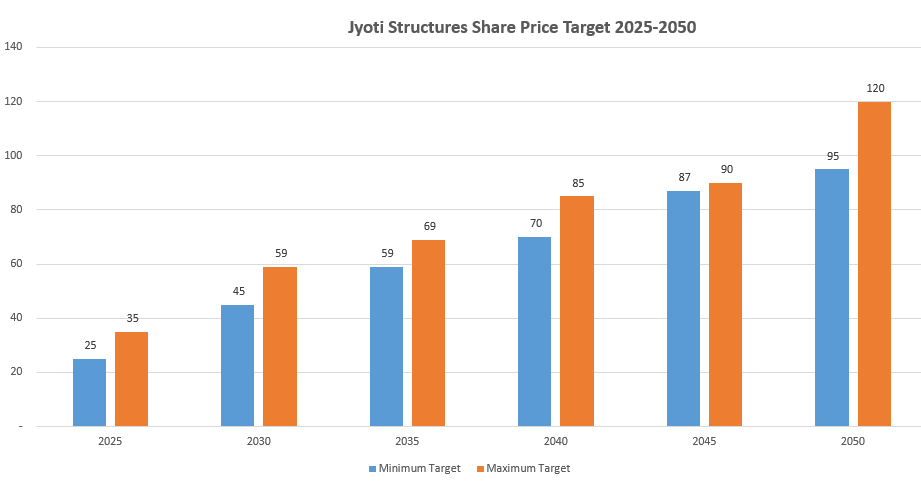

Jyoti Structures Share Price Target 2025-2050

| Years | Minimum Target | Maximum Target |

| 2025 | Rs 25 | Rs 35 |

| 2030 | Rs 45 | Rs 59 |

| 2035 | Rs 59 | Rs 69 |

| 2040 | Rs 70 | Rs 85 |

| 2045 | Rs 87 | Rs 90 |

| 2050 | Rs 95 | Rs 120 |

Technical Analysis of Jyothi Structures

The stock is reading above the 200 EMA. If you see the chart the stroke took the support on the 200 EMA twice this year after supporting the 200 DMA the stock rallied 62% just in one month.

so, in the stock bullish mode one-day timeframe all the moving averages indicate the stock has a really strong buying

Conclusion

Currently, the stock is in bullish momentum, moving above the short-term, moving every long-term and medium-term moving average, and the stock also outperforming 48.18% versus a nifty 58.4% in the last month. The balance sheet of Jyoti Structures is now becoming good.

Disclaimer

we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their research and analysis and consult with financial experts before making any investment decisions.