Prakash Steelage Share Price Target 2025 The minimum target is. ₹10 and the maximum is ₹11.

Prakash Steelage is a penny stock with a market cap of 142 crores with a stock is 6.21. With the help of this article, you will understand the Prakash Steelage Company fundamentals and we will also do some technical analysis of the stock based on the Company’s previous return the technical analysis we will predict the price target of Prkash Tej for 2025, 2020, 32,040 and 2050.

We will see the companies, major things like company, sales net, profit, and company growth and we will also see who are the investors who are invested in this company so that we can also get a good point of view about the prkash company.

Also Can Read:- Force Motors Share Price Target 2025

Prakash Steelage Company’s fundamental

| Company Name | Prakash Steelage Ltd |

| Market Cap | ₹ 133 Cr. |

| NSE | PRAKASHSTL |

| Return over 3years | 121 % |

| 52-Week High/Low | ₹ 16.6 / 3.20 |

| Sales growth 3Years | 43% |

| Debt | ₹ 25.6 Cr. |

| EPS | ₹ 1.31 |

| Industry PE | 29.6 |

| Stock PE | 5.81 |

| Face Value | ₹ 1.00 |

| Website | http://www.prakashsteelage.com/ |

Technical Analysis of Prakash Steelage

For the past month, the stock has continuously hit a lower circuit from ₹16.20 stock is continuously hitting the lower circuit and then the stock is normally trading at ₹8.20 so in the nearby around ₹7.25 they have good support if you do the Fibonacci retracement golden ratio comes around ₹12 but the

stock is currently trading lower than this and also Trading below the 250 DMA average but near the 200 DMA if the stock takes support on the candle, then the stock can give a good movie because first of December stock takes support on the 200 EMA then the stock gives 200% now again stock near to this average then can give a Returns from this point.

Prakash Steelage Share Price Target 2025-2050

| Years | Minimum Target | Maximum Target |

| 2025 | ₹10 | ₹11 |

| 2026 | ₹13 | ₹15 |

| 2027 | ₹16 | ₹18 |

| 2028 | ₹18 | ₹20 |

| 2029 | ₹22 | ₹24 |

| 2030 | ₹25 | ₹30 |

| 2035 | ₹31 | ₹38 |

| 2040 | ₹40 | ₹50 |

| 2045 | ₹55 | ₹65 |

| 2050 | ₹80 | ₹90 |

Prakash Steelage Company

Pros

- In the past five years, the company maintained a healthy cash flow of 60.91% the industry only 18.3%

- The stock has no red flag

- Showing good signs of profitability on a quarter and quarter basis.

- Companies financially stable

- The net income of the company has grown regularly well in the past five years is 4106.51% in the industry average of only 626.72%

- The revenue company is also very good compared to the industry industry only 17.51%, and the stock revenue grew 95.52%

Con

- The company is very poor in efficiency.

- The evolution of a Company is also expensive

- The net profit decreased quad and quarter by 40.12%.

- The current ratio is lower than the industry over the past five years the current ratio of the company, is 18.94% in the industry an average of 139%

- Company Pay zero rupees of the dividend

Prakash Steelage Share Price Target 2025

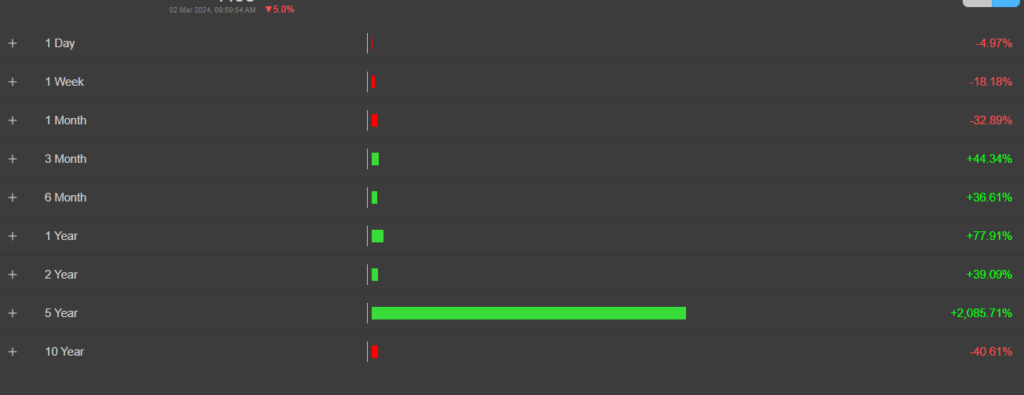

The stock returns have not been stable for the past month. The stock is contributing a stock fall of 31.67% but the past three months and the six-month return are 50.46% and 43.86% and the past five returns or 2085.71% if you

see past any returns that is only -36.34% so it’s a very volatile stock. this is a penny stock so high risk related to the stock. Prakash Steelage Share Price Target 2025 The minimum target is. ₹10 and the maximum is ₹11.

Prakash Steelage Share Price Target 2030

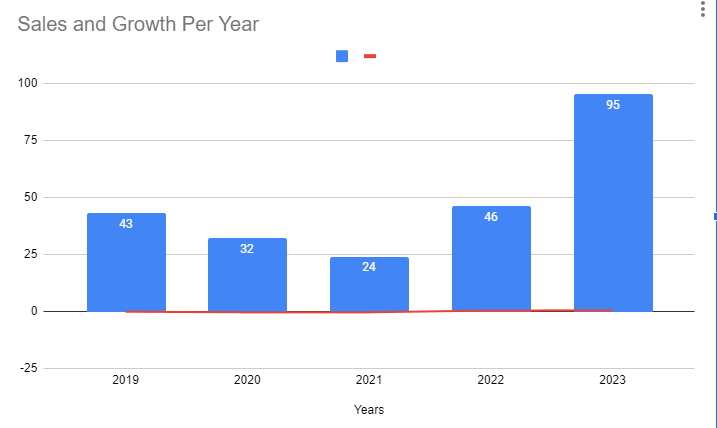

The company is reducing its debt. The company is expected to give a good quarterly result. The sales of the company have been stable and increasing since 2018. In March 2018, the sales were 40 crores

now in March 2023. The company sales have increased to 95 crores but previously the company had sales of 900 crore 700 crore 800 crore like this. Prakash Steelage Share Price Target for 230 minimum expected ₹25 the maximum is ₹30.

Prakash Steelage Share Price Target 2040

Prakash industries have less shareholding to have to the promoters. They have only 33.51% of holding and the rest of the holding public have 66.34%, and the government had 0.15% of holding the promoter hold holding is reduced from 48.18% to 33.51%.

For healthy shareholding, the promoter should have the maximum amount of holding, and holding should be increased year and year not reduced. Prakash Steelage Share Price Target 2040. The minimum target is ₹40 and the maximum target is ₹50.

Prakash Steelage Share Price Target 2050

Predicting the share price target for 2015 is tough but we can make the average prediction of the stock price where the stock price would be in 2050. Prakash Steelage Share Price Target 4050. The minimum target is ₹80 and the maximum target is ₹90.

Conclusion

Overall the company is financially stable, and if you see the stock chart, then you will find out the stock runs most of the time run the upper circuit and lower circuit if you are the risk taker, then this is the stock that can give you high returns otherwise, this will Stop can lose your money. Because if you want to make good money from the stock, the entry should be good and proper.

We are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their research and analysis and consult with financial experts before making any investment decisions.

Above mention Share price target is based on our analysis and the Stock’s past returns. The actual Share price may be different from the target price. because of factors that may change in the future.

FAQ

What is the share price target of Prakash Steelage in 2025?

Prakash Steelage Share Price Target 2025 The minimum target is. ₹10 and the maximum is ₹11.

What is your price target for Prakash Steelage in 2027?

Prakash Steelage Share Price Target 2025 The minimum target is. ₹16 and the maximum is ₹18.