According to the analysis of the stock returns, Praveg Share Price Target for 2025. The minimum is ₹1200 and the maximum is ₹1300.

Praveg Company was incorporated in 2016 after the merger of Praveg Communication Limited with the sword and the shield farm limited. The company is in the sector of hotels and restaurants with a market cap of 2078 crores.

Also Read:- 417% Returns Just in 1 Year from this MultiBegger Stock?

About the Praveg Business

The company has mainly operated in tourism, hospitality, and event exhibitions for over 20 years.

Tourism and hospitality

In FY2023, the tourism and hospitality business is 43%. That was 32% in fiscal 2021. they were currently managing 10 resorts during the financial year 2023. They introduced two new resort tent city beach restaurants in Daman.

Event and exhibitions

From the events, the exhibition company generated 57% of the business financially at the 2023 event an exhibition in Finance, and 2021 business 68%.

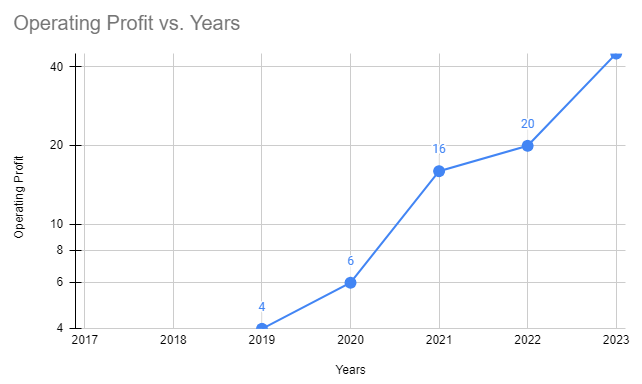

Fundamental analysis of Praveg company

| Company Name | Praveg Ltd |

| Market Cap | ₹ 2,095 Cr |

| ROCE | 56.2 % |

| Return Over 3years | 140 % |

| 52-Week High/Low | ₹ 1,300 / 409 |

| Sales growth 3Years | 12.3 % |

| Debt | ₹ 1.55 Cr. |

| EPS | ₹ 7.47 |

| Industry PE | 41.2 |

| Stock PE | 127 |

| Face Value | ₹ 10.0 |

| Website | https://praveg.com/ |

Praveg Stock Share Holding Pattern

| Share Holders | Mar 2023 | Mar 2024 |

| Promoters + | 62.00% | 48.18% |

| FIIs + | 3.01% | 6.52% |

| DIIs + | 0.04% | 3.41% |

| Public + | 34.96% | 41.88% |

| No. of Shareholders | 11,556 | 63,020 |

Praveg Stock Compounded Sales Growth

| 10 Years: | 47.00% |

| 5 Years: | 390.00% |

| 3 Years: | 12% |

| TTM: | -6.00% |

Return on Equity

| 10 Years: | 0% |

| 5 Years: | 46% |

| 3 Years: | 48% |

| Last Year: | 43% |

Stock Price CAGR

| 10 Years: | 0% |

| 5 Years: | 197% |

| 3 Years: | 140% |

| 1 Year: | 89% |

Technical analysis of Praveg Company

In the last 15 days of Trading the stock corrected by 31.72% from its recent high now, the stock is trading at ₹903.19

The volumes are also dry in the stock. The volume is also reducing.

Currently, the stock as a Praveg support S1 is ₹871.5 the support to is ₹830.5, and support Support 3 is ₹764.15 so these are the three supports where the stock takes reversal. The company has a good client base

Praveg Share Price Target 2025-2050

| Years | Minimum Target | Maximum Target |

| 2025 | ₹1200 | ₹1300 |

| 2026 | ₹1290 | ₹1350 |

| 2027 | ₹1400 | ₹1490 |

| 2028 | ₹1500 | ₹1590 |

| 2029 | ₹1600 | ₹1699 |

| 2030 | ₹1700 | ₹1800 |

| 2035 | ₹3000 | ₹3200 |

| 2040 | ₹3100 | ₹3300 |

| 2045 | ₹3500 | ₹3600 |

| 2050 | ₹4500 | ₹5000 |

Praveg Stock expert opinion

Pro and con of PRAVEG stock

- Stock pay dividend in financial 2020 to the stock pay dividend of ₹4.5

- Maintain a good OPM of more than 40%.

- Past three-year stock CGR is 130%

- Past three years returns On Equity have been 48%

- The companies are almost debt-free

Cons

- Stock is Trading 12.4 times its book value

- The promoter holding has decreased over the last quarter by 3.77%.

Conclusion

The company is financially releasable the operation agency of companies, is quite good, but the evolution of companies high the ownership is below the average. because the promoter holding is decreasing good thing is that the FII is increasing its holding.

We are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their research and analysis and consult with financial experts before making any investment decisions.

FAQ

What Share price target is Praveg stock for 2025?

According to the analysis of the stock returns, Praveg’s share price target for 2025. The minimum is ₹1200 and the maximum is ₹1300.

What Share price target is Praveg stock for 2030?

The expected share price target for PRAVEG Company’s minimum price is expected ₹1700 and the maximum is ₹1800.

Is it good to invest in Praveg Stock for the long term?

Praveg stock’s past year returns are 114.15%. which consider good returns and Sales are also growing.

Is Praveg Stock is fundamentally Strong?

Praveg’s company is financially strong and operation efficiency is good. Stock is a fundamentally Strong Company.