PVP Ventures Share Price Target for 2025 minimum is ₹35 while the maximum Target is ₹59.

The PVP venture is engaged in the business of developing the urban infrastructure and the investment in various ventures. The company has a business in the following segments real estate media and entertainment special solutions.

PVP Ventures stock is Trading above the 52-week high. The stock is trading at ₹26.25 hitting the upper circuit from the last two days and trading above the long-time and short-moving averages.

About PVP Ventures Company

- PVP Ventures Limited mainly does real estate business.

- They work with Unitech Limited and Arihant Housing & Foundation Limited on some projects.

- The company owns land near Hyderabad’s International Airport, in a place called Shamshabad.

- This land is managed by a company called ‘New Cyberabad City Projects Private Limited,’ which is a part of PVP Ventures.

- PVP Ventures is also involved in Picture House Media Limited, which helps the Indian entertainment industry with money.

- In FY22, the company’s debt amounted to 371 Crores.

- Repayment delays occurred in FY21, with Rs. 30.41 Crores overdue for Tranche A Debenture holders and Rs. 87.64 Crores overdue for Tranche B Debenture holders.

- The company provided advances to several group companies and subsidiaries.

- Despite the advances, the company has faced challenges in recovering them.

417% Returns Just in 1 Year from this MultiBegger Stock?

PVP Ventures Company Fundamental

| Company Name | PVP Ventures Ltd |

| Market Cap | ₹ 726 Cr. |

| NSE | PVP |

| Debt to Equity Ratio | 0.18 |

| 52-Week High/Low | ₹ 26.3 / 5.90 |

| ROE | 127 % |

| Debt | ₹ 25.6 Cr. |

| Profit growth | -139 % |

| Industry PE | 31.5 |

| Stock PE | 4.75 |

| Face Value | ₹ 5.39 |

| Website | http://www.ssiworldwide.com/ |

PVP Ventures Share Price Target 2025-2050

| Years | Minimum Target | Maximum Target |

| 2025 | ₹35 | ₹59 |

| 2026 | ₹60 | ₹89 |

| 2027 | ₹90 | ₹140 |

| 2028 | ₹140 | ₹195 |

| 2029 | ₹200 | ₹263 |

| 2030 | ₹265 | ₹377 |

| 2035 | ₹700 | ₹755 |

| 2040 | ₹1,088 | ₹1,287 |

| 2045 | ₹1,620 | ₹1,670 |

| 2050 | ₹2,003 | ₹2,399 |

PVP Ventures Share Price Target 2025

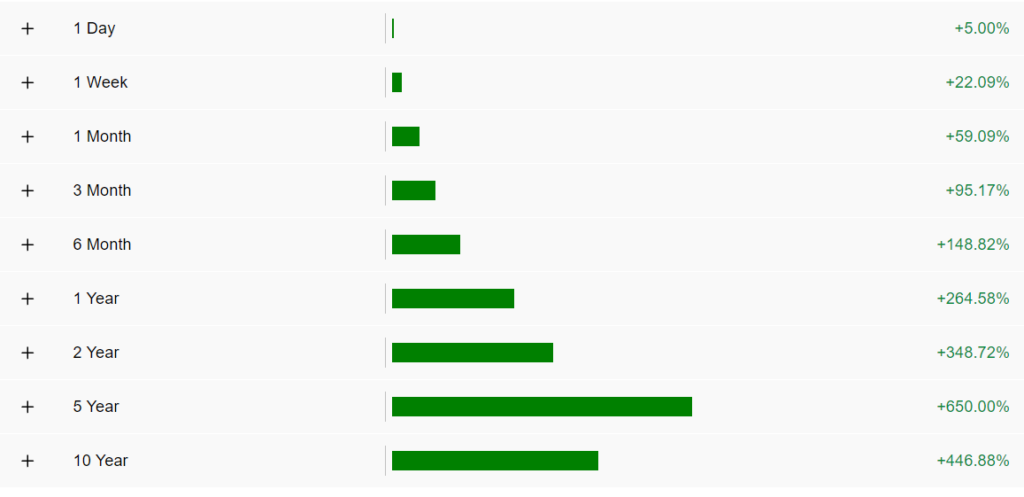

The returns from the PVP venture stock are crazy. In the last month, returns from the stock were 59.1%, and in the last six months written from the stock was 148.8% in the past year written is 264.6%. We expect the same return from the stock in the future then the PVP Ventures Share Price Target for 2025 minimum is ₹35 while the maximum is ₹59.

PVP Ventures Share Price Target 2030

The sales of the PVP venture in the year 2023 will increase by 72% in the year 2022 which will increase 63% but if you see the growth from 2017 to 2023 that would be -18% but from the past two years the growth is really good.

136% Returns By this Stock? Should You Invest NHPC Share Price Target?

| Years | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Sales | 156 | 58 | 37 | 44 | 18 | 49 | 176 |

| Growth Per Year | -63% | -57% | 16% | -144% | 63% | 72% |

The compounded sales growth of a company in the past three years is 59% in the past five years 25% in the past 10 years 14%. PVP Ventures Share Price Target for 2030. The minimum target is ₹265 and the maximum target is ₹377.

PVP Ventures Share Price Target 2040

PVP venture income statements have been really good in the last five years. The revenue growth has averaged 170.96% industry is only 1.5% and the net income of the company is also higher than the industry. The net income has an average of 60.76% and the industry average is -39.18%.

PVP is a good company but the evolution of stock is considered high. Currently, the stock is in the overbought Zone. PVP Ventures Share Price Target 2040 minimum target is expected around Rs 1000 in the maximum ₹1200.

PVP Ventures Share Price Target 2050

PVP Ventures’ share price target is 2050 the minimum target is 2000 and the maximum is ₹2400. Well, the PVP stock return we consider the stock is ₹250 because in the past the stock returns were around ₹650 so we calculated the average is 250% of the year.

The investor holding in PVP venture share the promoter for holding has Increased since 2017. In 2017 Promotor holding was 57.53% in December 2023 the promoter holding was 61.4% good thing is that the public holding degrees from 42.28% to 37.48% but the FII is in the DIIs increased their holding.

PVP Venture Company’s Strengths and Limitations

Strength

- The company has shown good profit growth in the past three years is 73.4%

- Revenue 76.69% in the past three years

- The company also cleared, its debt by 148.66 crore

- Promoting companies also increased to 61.40%

Limitations

- The company has a poor ROE of -41.13 over the past three year

- ROCE, 20.44% in the past three years.

Conclusion

PVP venture companies are financially strong, evolution is also justified. Ownership of a company also releases stability because there is not much change in a promoter holding so we can say the ship is stable but their agency companies are really bad. The company seems highly inefficient in the case of asset management.

FAQ

What is the business of a PVP venture?

Venture company in real estate, and the Ravan infrastructure media production in movie financing-related activities.

What is the share price of the PVP Venture in 2025?

PVP Ventures Share Price Target for 2025 minimum is ₹30 while the maximum Target is ₹35.

What is the share price target of the PVP venture for the next five years?

PVP Ventures Share Price Target for 2025 minimum is ₹90 while the maximum Target is ₹140

Is a PVP venture a good stock buy for the long term?

PVP venture companies, are financially stable, and the stock is also given a good written if a company balance sheet is stable, then stock can be good for the long-term.