The Madhav Infra Share Price Target for 2025 The minimum is ₹10 while the maximum is ₹17.

Madhav Infra Company Incorporated the 2010 Madhav project in a business of infrastructure development and solar power generation. The mother of the project is mainly in three businesses energy the second is infrastructure and the third is real estate.

136% Returns By this Stock? Should You Invest NHPC Share Price Target?

Madhav Infra Company

The Company Operates in the Following Segment

Energy

The complete green power project for the power generation transmission distribution, and the company is also undertaking solar and hydra projects in various states for power generation.

Infrastructure

The companies completed many BOT projects, road projects, Bus projects in the Water Supply project site, greeting projects, etc.

Real estate

In the real estate business, the business company has also built up many residential and commercial real estate projects, and the company designs engineering supplies for the procurement of power plants for various clients like GSECL, ONGC, and Energy Service Limited In real estate business, the business company has also built up many residential and commercial real estate project and the company design engineering supply of the procurement of power plant for the various client like GSECLONGC energy service Limited.

Madhav Infra Share Price Target 2025-2050

| Years | Minimum Target | Maximum Target |

| 2025 | Rs 10 | Rs 17 |

| 2030 | Rs 28 | Rs 40 |

| 2035 | Rs 42 | Rs 50 |

| 2040 | Rs 55 | Rs 70 |

| 2045 | Rs 68 | Rs 78 |

| 2050 | Rs 80 | Rs 110 |

Madhav Infra Share Price Target 2025

The stock’s previous returns are stable. The last week’s returns are 12.52% and last month’s returns are 8.02% and the last six month’s returns are 68.67%.

The returns given by Madhav Infra are good for the investors and also see the company’s net sales and their total income by the company profit after tax in the financial year to year company. The company expected to give good quality results in the stock, with a Stock Book value of 1.02 times its book value. The Madhav Infra Share Price Target for 2025 The minimum is ₹10 while the maximum is ₹17.

Madhav Infra Share Price Target 2030

The sales of Madam Infra are increasing year on year in March 2022. The net sales were Rs 460 Crores in March. The sales increased by 10%. And operating profit of companies also increased from 50 crores to 58 crores in March 2023.

The net profit of a company in my Aksh is the highest since 2015. Compounded sales growth in the past three years is 36% and past five years is 6%. Madhav Infra Company also maintains a good OPM of more than 10%. The Madhav Infra Share Price Target for 2030 The minimum is ₹28 and the maximum is ₹40.

Madhav Infra Share Price Target 2040

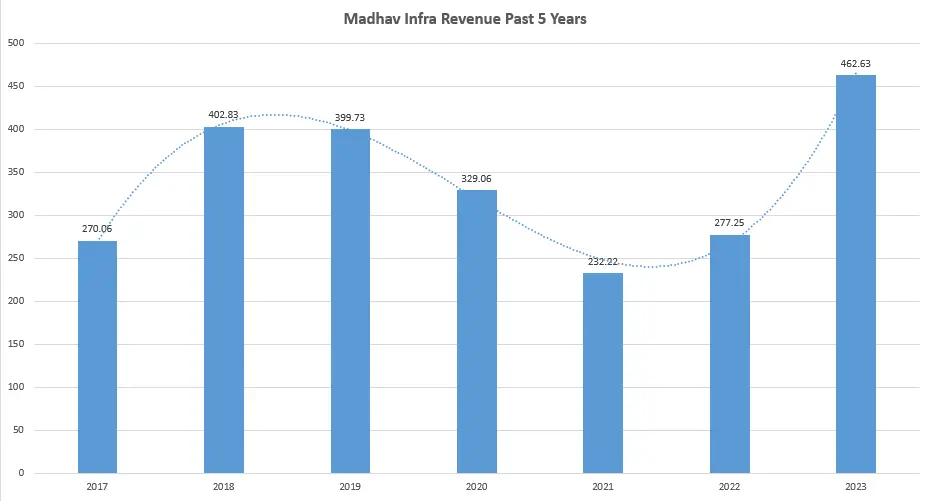

Now we understand the company’s revenue. The total revenue of the company is growing at a good rate past five revenue growth has averaged 11.24% and industry growth is 8.4 in 2023 the total revenue grew by 17%.

the net income of comp has grown by 440%. That is good the previous financial 2022 was 66.86% and the net income growth was 149.84%. That is really good growth. The profitability sign of a company also is high and strong growth in financials means the company also does not have any red flags. Madhav Infra Share Price Target for 2040 The minimum is. ₹55 and the maximum is 70.

Madhav Infra Share Price Target 2050

If we look at the assets of the Company and the balance sheets, then in the past five years, the debt-to-equity ratio has been 177.68 and the industry is 189.96%. and the current ratio of the past five years of companies, 168.06%, and industry averages of 111.45%

This number shows the company has good stability and the company has a free cash flow of 6.27 crore.

The company has a good amount of promoter holding in a company 69% and the public holding is 31%. Madhav Infra Share Price Target for 2050 The minimum is ₹80 and the maximum is ₹110.

FY23 Order Book Overview:

Total Order Book: Rs. 666 Crore (compared to Rs. 684 Crore as of June 30, 2022).

- Recent Addition: A 15 MW solar EPC project worth Rs. 117 crore at Vagra, Gujarat, was awarded after the last order book update.

- L1 Bidder Status: Secured as L1 bidder for two projects:

- Solar and RoB projects on an EPC basis worth Rs. 45 crore.

Recent Awards: Granted two projects valued at Rs. 130 crore for the construction of a bridge and a railway over a bridge. Projects are in the early stages of execution.

Diversification of Order Book:

Segment Distribution:

- Solar EPC projects: ~61% of the current order book.

- Road projects: ~26%.

- Bridges: ~6%.

- Railway over bridge projects: ~6%.

Client Profile:

- Majority of work orders from government entities:

- Urban local bodies, state government, and central government undertakings.

- Geographical Concentration:

- Geographic Distribution:

- Concentrated mainly in Madhya Pradesh and Gujarat.

- These regions form around ~94% of MIPL’s current order book.

Conclusion

The stock is financially stable. and the evolution of the company is fair and the stock is also really good for .8 and the sales of the Company and Karan quarter visits are increasing so fundamentally. We can see that the stock is stable and companies have shown really good profit growth in the past three years at 91.12%.

but at the time the stock is trading at a higher level, so we can wait for a little bit. Correction, in the stock stock is also trading above the 200 EMA the stock is in bullish momentum.

Disclaimer

we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their own research and analysis and consult with financial experts before making any investment decisions.

FAQ

Is Madhav infra good to buy?

Madhav infra is fundamentally strong and can be a buy near to 200 EMA.

What is the share price target of Madhav infra 2025?

Madhav Infra Share Price Target for 2025 The minimum is ₹10 and the maximum is ₹17.

Is Madhav Infra debt-free?

No, the company has a debt of 180 crore.

Good knowledge of stock picking.

Make a post on some good bluechips.