In the article, we are going to understand the Jammu and Kashmir Bank and we will also look at the J&K Bank Share Price Target 2025. Jammu and Kashmir bank stock is Trading in a Uptrend Trading above all the short-term and long-term averages.

The Jammu Kashmir bank is also really good. In the past year returns from the stock were 204.87%. Which is almost double the return in just one year. J&K Bank was incorporated in India and is publicly, held, and engaged in providing a wide range of banking services, like retail banking and corporate banking at operations.

136% Returns By this Stock? Should You Invest NHPC Share Price Target?

Fundamental Analysis of Jammu and Kashmir Bank

| Company Name | Jammu and Kashmir Bank Ltd |

| Market Cap | ₹ 15,785 Cr. |

| NSE | J_KBANK |

| Debt to Equity Ratio | 12.6 |

| 52-Week High/Low | ₹ 152 / 44.6 |

| ROE | 13.1 % |

| Debt | ₹ 1,24,919 Cr. |

| Book value | ₹ 95.9 |

| Industry PE | 13.1 |

| Stock PE | 9.80 |

| Face Value | ₹ 1 |

| Website | http://www.jkbank.net/ |

J&K Bank Share Price Target 2025

Jammu and Kashmir Bank’s compounding sales growth in the past three years is 3% in the past five years 7% if you see the compound and profit growth of the company over the past three years 44% and past five years is 42% but the stock is really good past three years is 69% and past five years 30%.

so from here, we can conclude that in the future, the store sales and the profit growth, and the stock CAGR will be higher than the current. J&K Bank Share Price Target for 2025. The minimum target is ₹195 the maximum is ₹238.

| Compounded Sales Growth | |

|---|---|

| 10 Years: | 4% |

| 5 Years: | 7% |

| 3 Years: | 3% |

| TTM: | 22% |

J&K Bank Share Price Target 2030

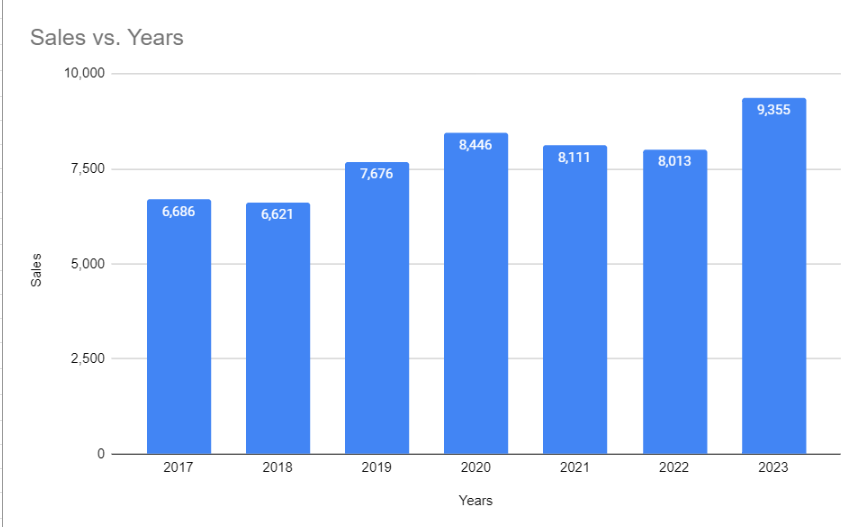

Jammu Kashmir Bank’s revenue growth is really good. In the past five years, the average revenue growth is 7.6% in 2023 which is the highest 14% revenue growth.

Over the past five years revenue growth averages 7.6% versus the industry average of 12.29%. J&K Bank Share Price Target for 2030 minimum target is Rs506 and the maximum target is ₹703.

J&K Bank Share Price Target 2040

The promoter holding of a company was reduced on March 2023 the promoter holding was 63.41% which is reduced by 5.40% It is not good for a company but the FII and the DII increased their holding in 2023, FY holding 2.24% increased to 5.8% and the DII has to hold 2.66% and now they increased to 7.81%.

| Years | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Net Profit | -1,633 | 203 | 464 | -1,183 | 428 | 495 | 1,181 |

| Growth Per Year | -112% | 56% | -139% | 376% | 14% | 58% |

The good thing is that the Public holding is reduced From 31.69% to 26.98%. So the overall shareholding pattern is considered to be strong because on March 2023 the promoter holding was 53.17% which means the promoter holding has also increased. The FII and DII also increased their holdings.

J&K Bank Share Price Target 2040 the minimum target is expected ₹1758 and the maximum ₹2080.

J&K Bank Share Price Target 2050

The company has good asset growth in financial years 2021 two financially 2022, with total asset growth of 8.57%, and in the year 2023 that is expected to grow to 11.75%

In the past three months, the mutual fund folding of the company has increased by 1.8%, which is considered to be good.

| Years | Minimum Target | Maximum Target |

| 2025 | ₹195 | ₹238 |

| 2026 | ₹240 | ₹313 |

| 2027 | ₹320 | ₹394 |

| 2028 | ₹400 | ₹460 |

| 2029 | ₹450 | ₹555 |

| 2030 | ₹560 | ₹703 |

| 2035 | ₹1,200 | ₹1,260 |

| 2040 | ₹1,758 | ₹2,080 |

| 2045 | ₹2,578 | ₹2,652 |

| 2050 | ₹3,149 | ₹3,771 |

Top Funds Mutual Funds Holding

| Funds (Top 5) | The rupee value of the stock held by the fund divided by the stock’s market cap Market-cap held | KOTAK MULTICAP FUND – DIRECT PLAN-GROWTH GROWTH | Change in the portfolio weight of the stock over the last 3 months 3M holding change | The rank of the stock in the fund’s portfolio based on its weight in the portfolio along with the change in the rank over the last 3 months Portfolio rank (3M change) |

| Quant Small Cap Fund – Growth – Direct Plan GROWTH | 1.06% | 1.07% | 0.02% | 42/130 (+26) |

| Kotak Multi Asset Allocation Fund – Direct Plan-Growth GROWTH | 1.04% | 1.85% | 0.85% | 51/73 (+6) |

| KOTAK MULTICAP FUND – DIRECT PLAN GROWTH GROWTH | 0.34% | 1.07% | 0.17% | 26/82 (+28) |

| Mahindra Manulife Large & Mid Cap Fund – Growth – Direct Plan GROWTH | 0.29% | 2.50% | -0.02% | 47/78 (-8) |

| Baroda BNP Paribas Multi Cap Fund – Growth – Direct Plan GROWTH | 0.19% | 1.34% | 1.34% | 54/78 (+19) |

The highest sting by the quant small cap was 1.0649%.

Conclusion

The company showed a good sign of profitability and efficiency and this is the entry point for the new investor because the stock is under price and it’s not an overboard zone. If we compare with the other companies like HDFC Life, the highest returns are given by the stock. The current stock is Trading above all short-term and long-term moving averages.

Above mention Share price target is based on our analysis and the Stock’s past returns. The actual Share price may be different from the target price. because of factors that may change in the future

We are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their research and analysis and consult with financial experts before making any investment decisions.

FAQ

What is the share price target of J&K Bank for 2025?

J&K Bank Share Price Target for 2025. The minimum target is ₹195 the maximum is ₹238.

What is the target of Jammu and Kashmir Bank for 2026?

J&K Bank Share Price Target for 2025. The minimum target is ₹240 the maximum is ₹313.

What will the share price of Jammu and Kashmir Bank be next 5 years?

J&K Bank Share Price target for next 5 years is ₹394.