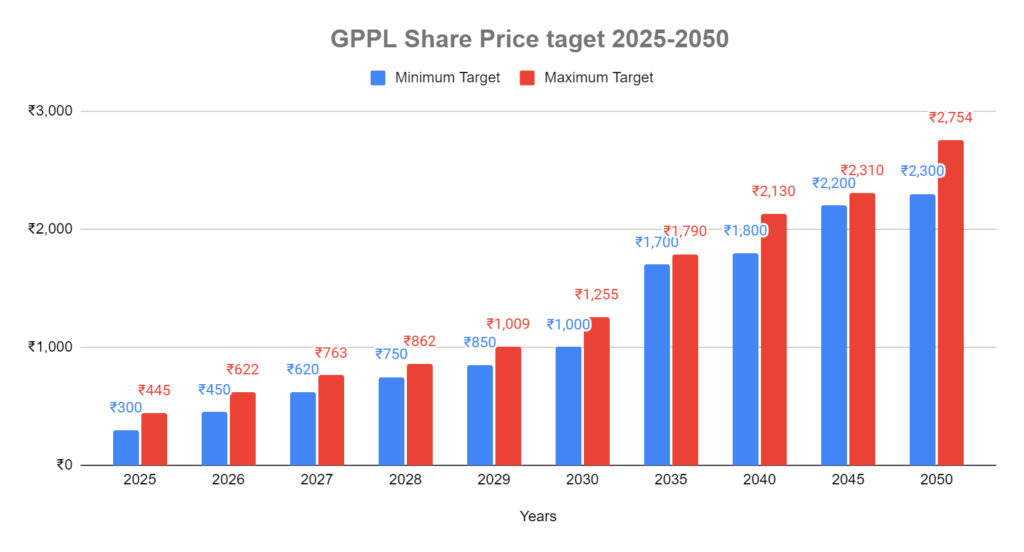

GPPL share price target for 2025. The minimum price is ₹300 and the maximum price can go up to ₹445.

Gujarat Pipavav Port is India’s first private sector port located on the southwest coast of Gujarat near Bhavnagar the trade route, that connects India with the US Europe, Africa, the Middle East on the site, and the Far East on the other side. This very important port in India.

Hello, investors in this article we are going to understand the GPPL Company and we will also discuss the GPPL share price target for 2025, 2030 2014, and 2050. We will also see the broker target and analysis target on the stock and we will also study the companies, balance sheet, company sales, and the profit growth of the companies growing.

136% Returns By this Stock? Should You Invest NHPC Share Price Target?

GPPL Stock Fundamental Analysis

| Company Name | Gujarat Pipavav Port Ltd |

| Market Cap | ₹ 9,587 Cr. |

| NSE | GPPL |

| Debt to Equity Ratio | 0.04 |

| 52-Week High/Low | ₹ 216 / 97.6 |

| ROE | 15.5 % |

| Debt | ₹ 87.9 Cr. |

| Book value | ₹ 43.2 |

| Industry PE | 31.7 |

| Stock PE | 25.8 |

| Face Value | ₹ 10.0 |

| Website | http://www.apmterminals.com/ |

Some of the main key points we will understand like sales growth, profit growth, ROE, and ROCE. These are the most important parameters for any company and we also study the shareholding pattern of the Company how the shielding pattern is changing and who is taking more shares of the company after that. We will also discuss the Company’s strengths point and the points so that you can easily understand.

417% Returns Just in 1 Year from this MultiBegger Stock

GPPL 5-Year Sales Growth

| Years | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Sales | 683 | 649 | 702 | 735 | 733 | 741 | 917 |

| Growth Per Year | -5% | 8% | 4% | 0% | 1% | 19% |

GPPL 5-Year Revenue Growth

| Years | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Revenue | 751 | 709 | 778 | 813 | 781 | 776 | 989 |

| Growth Per Year | -6% | 9% | 4% | -4% | -1% | 22% |

GPPL 5-Year Reserves Growth

| Years | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Reserves | 1,536 | 1,531 | 1,538 | 1,601 | 1,549 | 1,549 | 1,595 |

| Growth Per Year | 0% | 0% | 4% | -3% | 0% | 3% |

GPPL 5-Year Net Profit Growth

| Years | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Net Profit | 250 | 198 | 206 | 292 | 218 | 193 | 292 |

| Growth Per Year | -21% | 4% | 29% | -34% | -13% | 34% |

GPPL 5-Year Net Income Growth

| Years | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Net Income | 282 | 221 | 237 | 319 | 222 | 197 | 313 |

| Growth Per Year | -22% | 7% | 26% | -44% | -12% | 37% |

GPPL Share Price Target 2025

The sales growth of Company 2023 has increased by 19% from the previous year and if we see the average growth of the past five years, 4.5%. In 2022 sales group is only one percent.

| GPPL Share Price Target 2025 | |

| Months | Price |

| January 2025 | ₹300 |

| February 2025 | ₹306 |

| March 2025 | ₹315 |

| April 2025 | ₹318 |

| May 2025 | ₹325 |

| June 2025 | ₹331 |

| July 2025 | ₹338 |

| August 2025 | ₹348 |

| September 2025 | ₹400 |

| October 2025 | ₹408 |

| November 2025 | ₹437 |

| December 2025 | ₹445 |

we expect the company in the upcoming year the company at least 5 to 6% of the sales growth which will be helpful for the company’s product and end in an increase in revenue. GPPL share price target for 2025. The minimum price is ₹300 and the maximum price can go up to ₹445.

GPPL Share Price Target 2026

The GPPL target for 2026 is in January. The stock price is expected to ₹450 and then on August 5 ₹170 but in December 2026 the price is near to ₹620.

| GPPL Share Price Target 2026 | |

| Months | Price |

| January 2026 | ₹450 |

| February 2026 | ₹459 |

| March 2026 | ₹482 |

| April 2026 | ₹496 |

| May 2026 | ₹511 |

| June 2026 | ₹537 |

| July 2026 | ₹553 |

| August 2026 | ₹570 |

| September 2026 | ₹587 |

| October 2026 | ₹598 |

| November 2026 | ₹604 |

| December 2026 | ₹622 |

GPPL Share Price Target 2027

In January 2027 the price is near ₹620 which can be a little bit very but in the middle of the year price is about 671 and end of the year the price is near about ₹750.

| GPPL Share Price Target 2027 | |

| Months | Price |

| January 2027 | ₹620 |

| February 2027 | ₹626 |

| March 2027 | ₹632 |

| April 2027 | ₹645 |

| May 2027 | ₹664 |

| June 2027 | ₹671 |

| July 2027 | ₹691 |

| August 2027 | ₹705 |

| September 2027 | ₹726 |

| October 2027 | ₹741 |

| November 2027 | ₹756 |

| December 2027 | ₹763 |

GPPL Share Price Target 2028

GPPL’s share price target for 2028 is starting with ₹750 and at the middle of the year on June 28 prices near about ₹800 but at the end of 2028, GPPL’s share price is ₹862.

| GPPL Share Price Target 2028 | |

| Months | Price |

| January 2028 | ₹750 |

| February 2028 | ₹765 |

| March 2028 | ₹773 |

| April 2028 | ₹780 |

| May 2028 | ₹796 |

| June 2028 | ₹800 |

| July 2028 | ₹804 |

| August 2028 | ₹812 |

| September 2028 | ₹828 |

| October 2028 | ₹837 |

| November 2028 | ₹845 |

| December 2028 | ₹862 |

GPPL Share Price Target 2029

At the start of 2029, the price is about ₹850-₹853 but at the end of the year, you can see the price near to ₹1000.

| GPPL Share Price Target 2029 | |

| Months | Price |

| January 2029 | ₹850 |

| February 2029 | ₹851 |

| March 2029 | ₹853 |

| April 2029 | ₹870 |

| May 2029 | ₹878 |

| June 2029 | ₹887 |

| July 2029 | ₹905 |

| August 2029 | ₹923 |

| September 2029 | ₹951 |

| October 2029 | ₹960 |

| November 2029 | ₹979 |

| December 2029 | ₹1,009 |

GPPL Share Price Target 2030

GPPL stock’s past five returns are 159.39% and we expected the same stock returns in the future. if the stock gives 154% returns in the past five years, then the stock price in 2030 is a maximum price of ₹1250.

| GPPL Share Price Target 2030 | |

| Months | Price |

| January 2030 | ₹1,000 |

| February 2030 | ₹1,020 |

| March 2030 | ₹1,040 |

| April 2030 | ₹1,072 |

| May 2030 | ₹1,104 |

| June 2030 | ₹1,126 |

| July 2030 | ₹1,160 |

| August 2030 | ₹1,171 |

| September 2030 | ₹1,183 |

| October 2030 | ₹1,195 |

| November 2030 | ₹1,219 |

| December 230 | ₹1,255 |

GPPL Share Price Target 2040

The past 10 years returns given by the stock is 192.81% so if the stock gives us the same near the return in 10 then the stock price could reach to ₹2000.

| GPPL Share Price Target 2040 | |

| Months | Price |

| January 2040 | ₹1,800 |

| February 2040 | ₹1,818 |

| March 2040 | ₹1,854 |

| April 2040 | ₹1,891 |

| May 2040 | ₹1,929 |

| June 2040 | ₹1,968 |

| July 2040 | ₹1,968 |

| August 2040 | ₹2,007 |

| September 2040 | ₹2,047 |

| October 2040 | ₹2,068 |

| November 2040 | ₹2,109 |

| December 2040 | ₹2,130 |

GPPL Share Price Target 2050

Past 5 years, the debt-to-equity ratio has been 2.03%, vs the industry average of 105.44%. Over the last 5 years, the current ratio has been 354.08%, vs the industry average of 169.94%.In the Year 2023 company’s Net profit increased by 34%.

| GPPL Share Price Target 2050 | |

| Months | Price |

| January 2050 | ₹2,300 |

| February 2050 | ₹2,323 |

| March 2050 | ₹2,328 |

| April 2050 | ₹2,374 |

| May 2050 | ₹2,422 |

| June 2050 | ₹2,470 |

| July 2050 | ₹2,520 |

| August 2050 | ₹2,570 |

| September 2050 | ₹2,621 |

| October 2050 | ₹2,674 |

| November 2050 | ₹2,727 |

| December 2050 | ₹2,754 |

GPPL Share Price Target 2025-2050

Conclusion

GPPL Company Ownership strength is slightly missing the benchmark. operation efficiency-wise. Also companies stable, but it could be the company also improves their asset, employment, or the financial companies average by the evolution the companies bit expensive you see the shareholding pattern of the company the promoter holding is in increased from 2017 and the public holding is also increasing but the FII is and DII is reduced their holding.

Disclaimer

we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their research and analysis and consult with financial experts before making any investment decisions.

Above mention Share price target is based on our analysis and the Stock’s past returns. The actual Share price may be different from the target price. because of factors that may change in the future

FAQ

What is the GPPL Share Price Target for 2025?

GPPL share price target for 2025. The minimum price is ₹300 and the maximum price can go up to ₹445.

Is GPPL Company is Debt free?

No, GPPL has a debt of ₹ 87.9 Cr. The debt-to-equity ratio is very good 0.04.

What is the share price target for GPPL in 2030?

GPPL share price target for 2025. The minimum price is ₹300 and the maximum price can go up to ₹445.

GPPL is a Good Stock for the Long Term?

Ownership strength is slightly missing the benchmark and is financially stable.