Avance Technologies Share Price Target 2025 expected the minimum to be Rs 2 and the maximum is Rs 6.

Avance technology has Grown investor money by 1705% in just one year. Now the stock moves daily in the upper circuit and on the 18 Dec stock Delivery the volume of the stock is 100%. The stock has a market cap of Rs 147 crore.

Shree Ganesh Share Price Target 2025

The companies engage in provision of the mobile data services. The companies mainly offer the service code, service enterprises, mobile marketing, mobile, marketing solutions, electronics mail and web integration add integration program, etc.

The company was incorporated in 1985 Avance Technologies, the business of software and hardware resale.

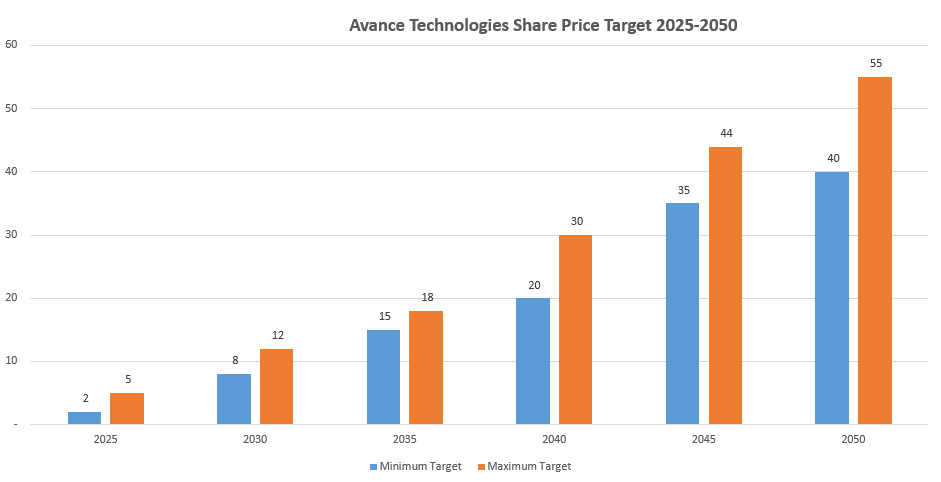

Avance Technologies Share Price Target 2025-2050

| Years | Minimum Target | Maximum Target |

| 2025 | Rs 2 | Rs 5 |

| 2030 | Rs 8 | Rs 12 |

| 2035 | Rs 15 | Rs 18 |

| 2040 | Rs 20 | Rs 30 |

| 2045 | Rs 35 | Rs 44 |

| 2050 | Rs 40 | Rs 55 |

Avance Technologies Share Price Target 2025

Well, as is a penny stock, the stock gives great returns to the investors returns off stock as follows in the Past 1 month’s returns are 35.35%, and part three month returns given by this stock are 184.62% And the past year’s returns from this stock is 1750%.

The company’s quarterly profit is really good. The sales of companies grow on a quarter and quarter basis. Avance Technologies Share Price Target 2025 expected the minimum to be Rs 2 and the maximum is Rs 5.

Avance Technologies Share Price Target 2030

The company has a really good number of sales from the past year in September 2022. The company has sales of only 1.4 crores but in September 2023 the company had a sales growth of 16.97% as we can see the sales grew by 91%.

So you see the company has changed their strategies in terms of the sales sales increased in the net profit of companies also increased from 4000 to 70 lakh. The company increased its sales. The expected sale next year is about Rs 232 crores. Avance Technologies share price target for 2030. The minimum is Rs 8 while the maximum is ₹12.

Avance Technologies Share Price Target 2040

Well, we see the sales of the Company and the net profit of companies increasing well now we understand the balance sheet. The company has current assets are 47.46 crore which is an increase of 3.44% from the previous year and the current liabilities have increased by 13% from the previous.

As the company has total assets of 404.70 crore and total liabilities company has Rs 63.43 crore we can see the company has a good amount of assets and the total liability of the company is low but as the total liability has increased in the Past year 13% that is not good because the current asset is only increased by 3%.

It means that the company is taking more money as a liability, which is not good for the company, but the company is increasing its sales, which could be considered a good point. Avance Technologies Share Price Target for 2040 is expected to be ₹20 minimum and the maximum is ₹40.

Avance Technologies Share Price Target 2050

The company is revenue. Growth is higher than the industry average. The industry averaged 13.67% in the past five years but the company revenue has grown by 1325.34%.

which is good for the company and the past two years the company’s total revenue has also increased from the financial 2021 to the financial year 2022. The company’s revenue increased by 6688.24%.

That is massive in 2022, financial return three and revenues grew by 164.64%, and the net profit of the company increased by 165.57% This is the number is good all all points show that the company is in really good profit. Avance Technologies Share Price Target 2050 The minimum is expected to be ₹40 and the maximum is ₹55.

SWOT Analysis of Avance Technologies

Strength

- A new 52-week high, made by the stock

- And the company has no debt

- Show the strong growth in EPS annually

- The stock 42% in just one month

Weaknesses

- Promoter holding decreasing quarter-quarter basis

- The liabilities of companies increasing

Opportunity

- The highest recovery from 52 week-low

Threat

- The stock has a no-threat

Technical Analysis of Avance Technologies

If you see from the technical prospect, the stock has made a new 52-week high which is ₹.47 which is really. Stock generates a really good pattern on a weekly timeframe in the stock. Is Trading of the short-term and long-term moving averages?

But after this, we can see a little bit of the collection in stock, so that can be a good point for buying.

Conclusion

The sales net profit, revenue of companies, Goring err, wages, and quarter and quarter visit can be considered a good part of a company because the profit and loss statement of companies increasing now the company, becoming financially strong but on another side, the promoter holding is increasing in September quarter the promote holding was .88% now the promote holding degrees to .68%. It means the company is selling its stock.

which is not good. but being an investor, you can find a good entry point after a little bit of collection in stock. The above-mentioned target is given based on the current condition and the current stock move and what are the stock previously written in the future the price may change based on that condition.

Disclaimer

we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their research and analysis and consult with financial experts before making any investment decisions.

FAQ

What is the target of Avance Technologies in 2025?

Avance Technologies Share Price Target 2025 expected the minimum to be Rs 2 and the maximum to be Rs 5.

What is the target of Avance Technologies in 2030?

Avance Technologies share price target for 2013. The minimum is eight rupees while the maximum is ₹12