Easy Trip Share Price Target for 2025. The minimum target is ₹85 and the maximum target is ₹97.

If you are curious about an Easy Trip Share Price Target 2025-2024-2026 and 2030. and if you want to understand the company’s balance sheet, what are the company, pros and cons? Is it good to invest for a long term or a short term? Where should I invest in the stock or not and if I am already invested then what should I do?

Is Madhav Infra is Good Investment?

So these are the types of questions we are going to cover in the article, and we will also do a fundamental analysis of the stock based on that we will give the share by target for the future.

Easy Trip Share Price Target 2024

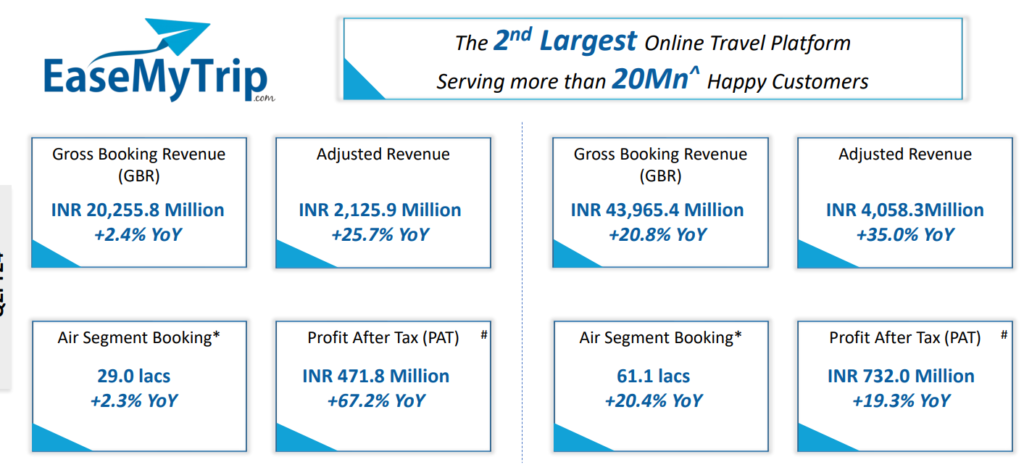

Easy Trip is a rapidly expanding online travel portal in India. It is the second largest company in the industry, offering a variety of travel products and solutions such as air tickets, hotels, holiday packages, and bus tickets. Despite being profitable, it serves only budget-conscious customers.

The company did a bunch of acquisitions and partnerships like the Spree hospitality acquisition, and YoloBus. some partnerships like flybig partnership, Spice Jet partnership, Just Dial partnership, Nutana, aviation, Eco hotel, and resort Limited book travel plate, Limited trip shop travel Private Limited. so the company is really good in the partnership and the acquisition and holding good market share so that is an Easy Trip Share Price Target for 2024. The minimum target is ₹60 and the maximum target is ₹70.

Easy Trip Share Price Target 2025

The sales of this easy trip are increasing year on year basis in March 2018, my trip sales were 100 crores now in March 2023 the company sales were 430 crores so there is a really good increase in sales same as the operating profit in 2018 -10 crores and now March 23 the company has 185 crores of the profit. Easy Trip Share Price Target for 2025. The minimum target is ₹85 and the maximum target is ₹97.

Easy Trip Share Price Target 2026

Now see the compounded profit growth of a company in the past three years 64% and in the past five years is 103% which is considered to be a good return on equity is also really good in the past three years is 49%.

Easy Trip’s net profit is also really good if you look at the past five years in March 2018 the company had a loss of 10 crores so the net profit is zero but now in March 2023, the net profit of the company is Rs 147 crores

Easy Trip Share Price Target for 2026. The minimum target is expected ₹115 and the maximum target is ₹135.

Easy Trip Share Price Target 2030

The total revenue of the Company’s financial year 2021 financial 2022 has increased by 65.68% now in 2023. The total revenue of companies increased by 85.86%. That is good for the Company and the net income of the company also increased good 26.73% if we look at the last five years, the company income has grown higher than the industry revenue has an average of company 33.06%, and the industries are only 13.79%

The total assets have also increased by 44.27% from the previous year and the liability has only increased by 32.11%. The total assets of the company are 696.89 crore and the total liability of the company is 326.5% which is a really good debt ratio of a company. Easy Trip Share Price Target for 2026. The minimum target is expected ₹140 and the maximum target is ₹155.

| Years | Minimum Target | Maximum Target |

| 2024 | Rs 5 | Rs 7 |

| 2025 | Rs 10 | Rs 15 |

| 2026 | Rs 17 | Rs 30 |

| 2027 | Rs 25 | Rs 35 |

| 2028 | Rs 27 | Rs 45 |

| 2030 | Rs 50 | Rs 60 |

Easy Trip Stock Pros and Cons

Pros

- The company showing a good sign of profitability and efficiency

- Strong financial growth story over the year

- Over the past year, the company’s net income has been really good, and the industries

- Deliver a good profit growth of 103% CHR or past five-year

Cons

- The stock is trading at 11.1 times its book value

- The promoter holding decreased in over last quarter is 10.6%

- Promoter holding has increased by 1.42%.

- FII decreased holding at 0.12%.

Easy Trip Share Shareholding Pattern

Easy Trip Share Price History

Is Easy Trip a Good buy for the long term?

For the recent scenario, the stock gave good returns in the past time, and nowadays, the stock is moving above the short-term and long-term moving so there are good. Chances of the stock can give a good momentum.

What is the future growth of easy trips?

Well, based on the current scenario and the past quarter and a few years back, we can share the growth scenario of my trip.

As the company basis, sales are increasing and the net profit is also increasing so we can understand where the stock is going to give a return. in coming time

What is a long-term target for easy trip share?

These are the feature targets full easy trip share prices.

I have 100 shares of Easy Trip What should I do?

If you bought the stock recently, you should have a good profit because last week the stock gave returns of 16.77%. In the last month, the stock gave a return of 21.57%.

For the stock, you can hold it for a long and also monitor the company’s balance sheet because, in a recent quarter, the sales of companies are increasing. In 2023 the company sales almost doubled from the previous year.

I have 80 shares of my 187 since the IPO. I am a long-time investor. What should I do?

Being a longtime investor, you should always take care of the company, profit and loss statement, and how the company sales are decreasing or increasing based on that you should take any action and also basic understanding of the balance sheet because if you see the sales of Company start decreasing so you should be aware of the company sales also.

Long time investor doesn’t mean that you buy a stock and forget, just always watch the stock, that you have invested.

See, it is not good to hold such stock for a long time.

Currently stock is trading at ₹48. If you are still holding this dog, then you have a loss of around ₹11,120 so I would suggest that you have a loss or you can do an average.

Or you can invest in other stocks for good returns.

Disclaimer

we are not SEBI registered advisors, our objective is only to provide detailed information related to the company’s business to the public. Investors should conduct their research and analysis and consult with financial experts before making any investment decisions.